By studying a clients’ decision pattern in TrueProfile, you can gain deep insight about their thought process and attitudes—much like physicians can learn a lot about a patient’s health situation by studying X-ray images or blood test results.

However, just as physicians needed learn how to interpret an X-ray image when the X-ray arrived on the scene around 1900, advisors need to learn how to interpret decision patterns that come with revealed preferences technology. It’s the equivalent of knowing how to spot a hairline fracture or bone density issues in an X-ray.

The guidance below is meant to help you interpret client decision patterns, spot insights, and set up rich client dialogue. TrueProfile is a powerful diagnostic tool, but as with any new diagnostic technology, it does require some practice in applying it. Read on to shorten your learning curve.

Interpreting Decision Bars

The first place to look when a client has completed their TrueProfile is the Risk Report. Locate the decision bars on the report.

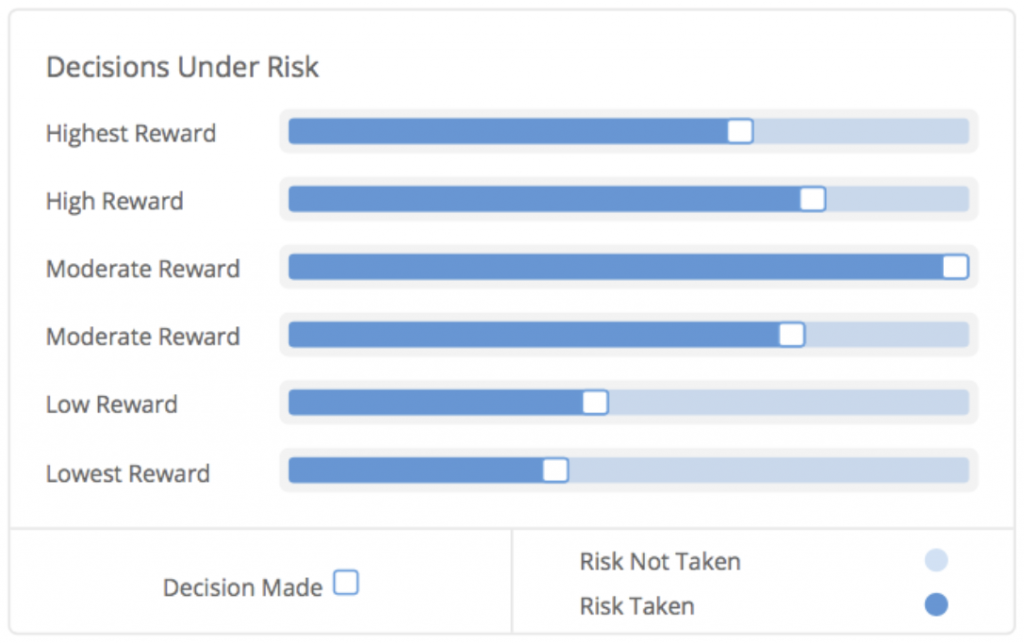

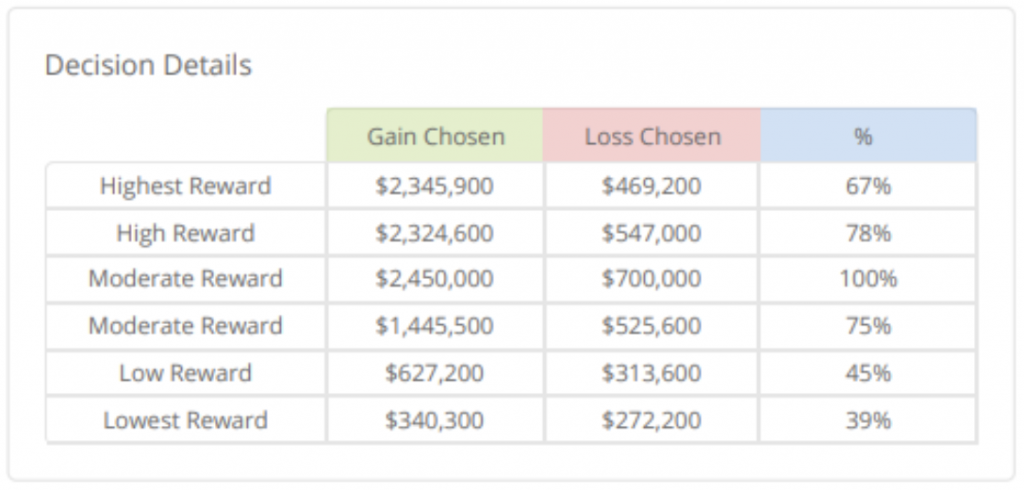

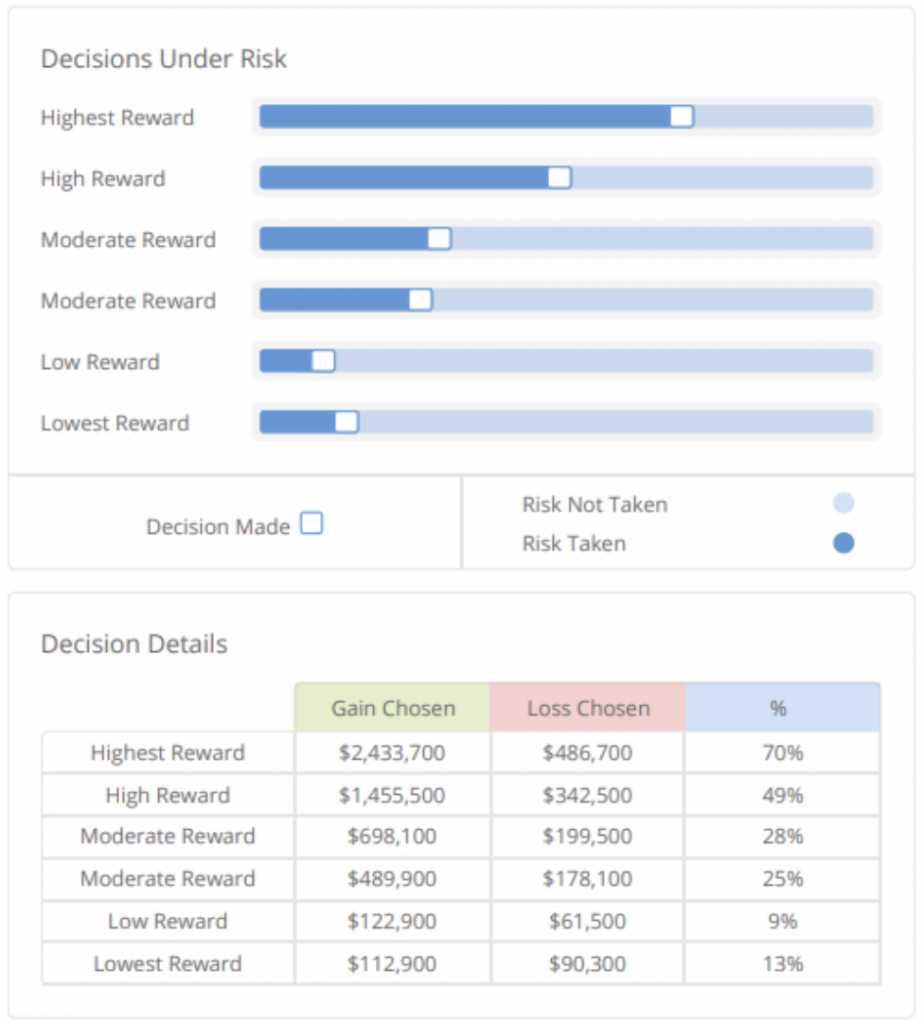

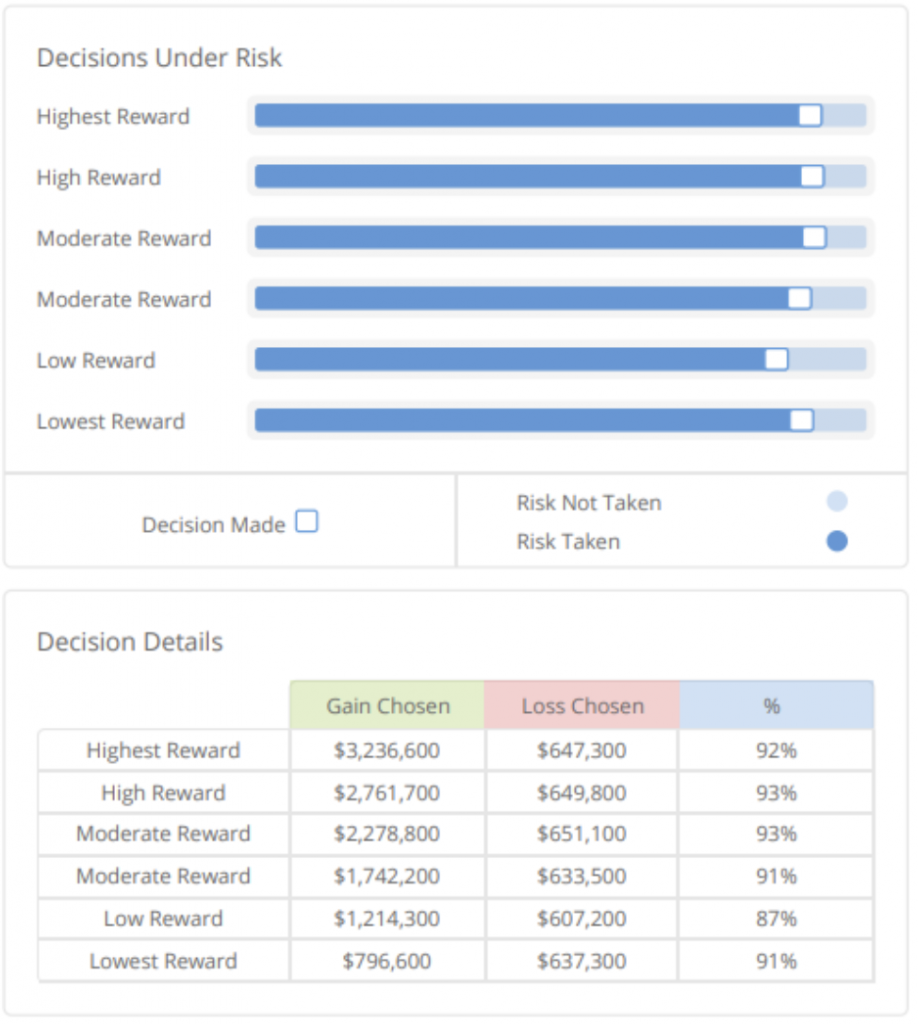

The bars are ordered from the highest reward (in other words, the one with the most favorable gain-to-loss ratio) to lowest reward. By studying the pattern in the bars from top to bottom, you’ll gain important insight about a client’s risk preferences.

We’d recommend viewing the Risk Report to interpret these decision bars. You’ll find below the bars the precise dollar figures for each scenario—the max gain and loss for that scenario, and the client’s chosen gain/loss.

Normal Decision Patterns

At a glance, you’d expect to see decision bars look like one of the three images below for most of your clients. Each of these represent rational decision making behavior.

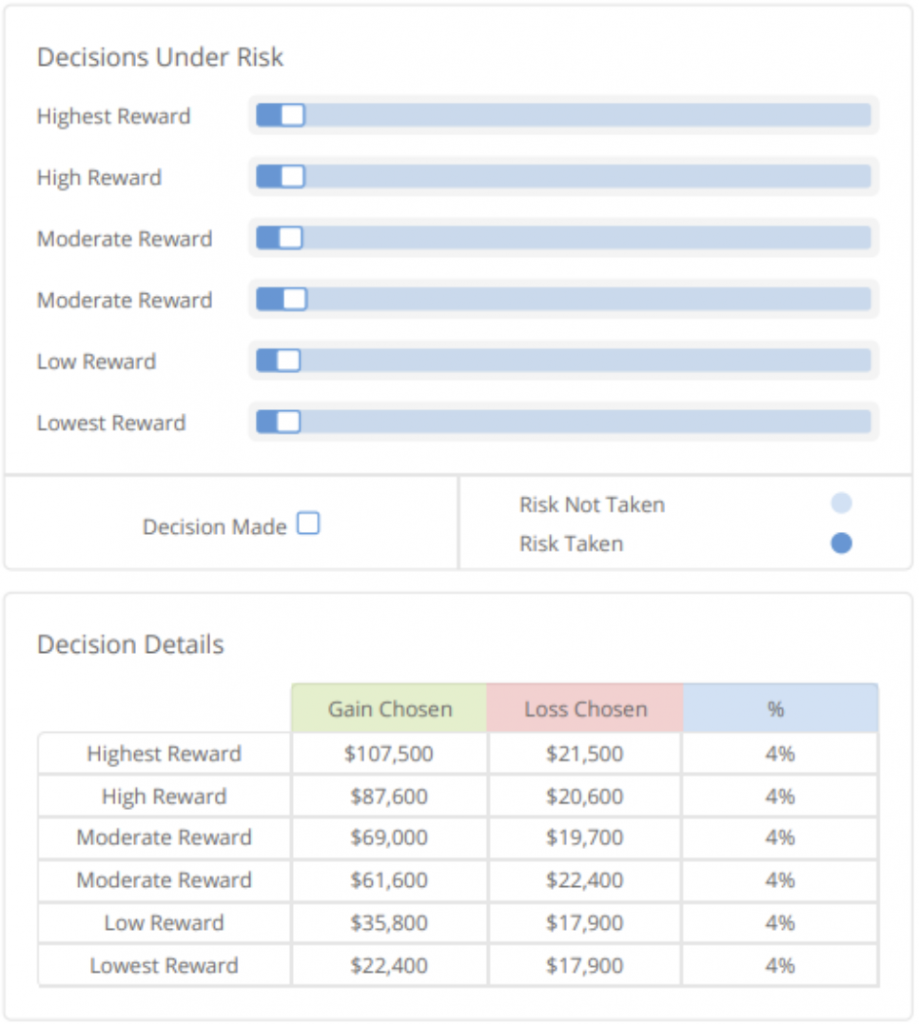

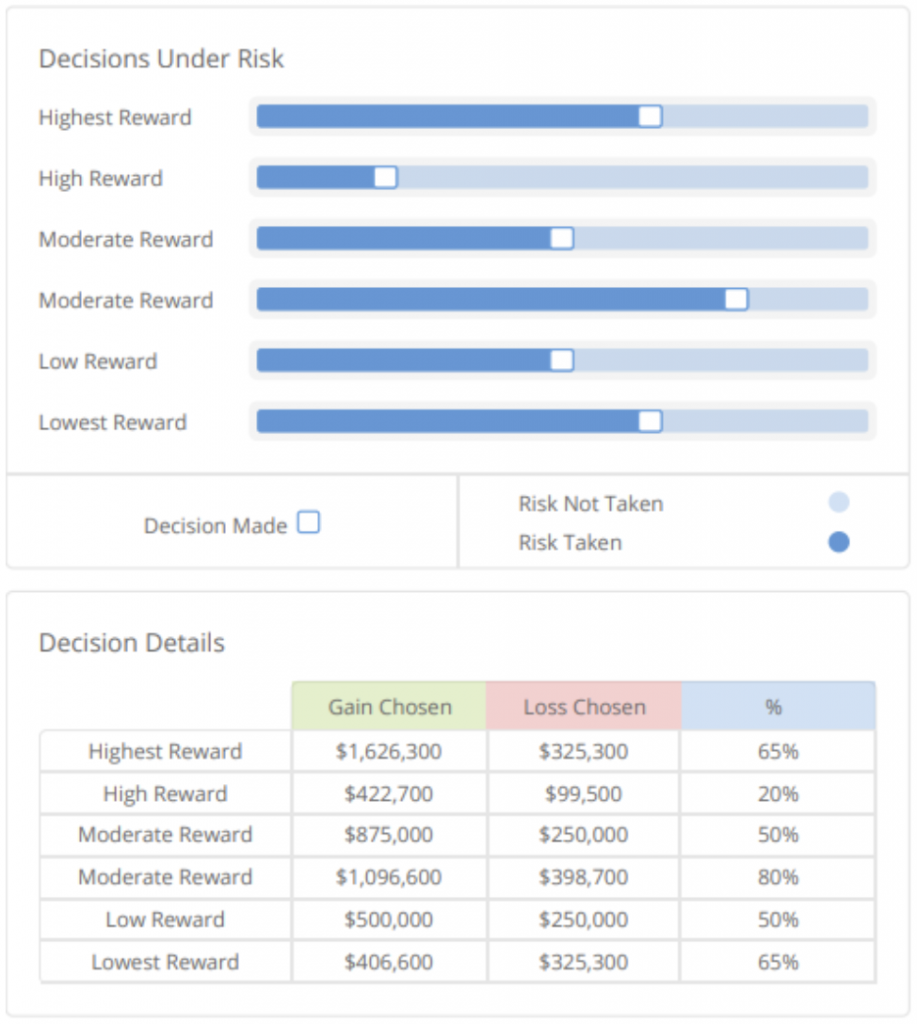

Many clients will take more risk on high opportunity scenarios and gradually less risk on lower opportunity scenarios (see image below)

Some client will take a consistently high, medium, or low amount of risk across all scenarios (see images below–top one is high risk tolerance, bottom one is low risk tolerance).

Here’s a deeper dive into these normal patterns.

Medium to high risk tolerance, with medium or high loss aversion

Clients show they are willing to take moderate to high risk on the high opportunity scenarios, as indicated by bars that extend middle to far right at the top. But, on lower opportunity scenarios (at the bottom), the bars are closer to the left hand side. The client is showing loss aversion here, because they feel the pain of losses more intensely. These are clients who often feel as though they have something to protect. You will often see loss aversion creep up when clients are expecting children or feel shaky in their employment situations. Explore what these clients may be protecting, and why. Those with longer time horizons on their goals may benefit from education on the advantages of long-term investing, and the opportunity they will have to make up near term losses.

Medium to high risk tolerance, with low loss aversion

You’ll spot these clients by their relatively consistent appetite for taking moderate to high risk across all scenarios. They don’t take much money off the table in the lower opportunity scenarios. These clients are likely to feel they have time to make up for near term losses. Explore with this client how they would react to losses, were they to occur in the next year.

Low risk tolerance

These clients chose to take relatively little risk consistently across the scenarios, no matter how much opportunity was present. They are skittish about putting money at risk. It can be good to ask these client’s why they decided to put so little at risk. Check on the client’s time horizon for the goal(s) they stated—it could be that the goal has a short time horizon and the client has in mind a minimum amount they need to fund that goal. It could also be that the client has experienced significant losses in their investment history. These are worth exploring to better understand why the client is taking so little risk.

Unusual Decision Patterns

You will likely see some decision patterns that are unusual, or economically irrational. You can identify these patterns at a glance by looking for decision bars that bounce back and forth from top to bottom.

This kind of indecisive decision pattern will show up a your client’s Decision Consistency score. In the example above, that score is a 58. Anything less than a 95 is a compliance flag, and you should take extra care with these clients.

It could be that they client was multi-tasking while playing the activity, in which case you should re-profile the client (and ask them to focus!). But, it could also be that the client simply hasn’t internalized the relationship between risk and reward in an investment context. Spend some time educating these kinds of clients, and then re-profile them. If they continue to show inconsistent preferences like this, re-consider whether you could or should serve that client. These kinds of clients represent significant compliance risks for you.

6 Things to Look for in a Client’s Decision Pattern

- Overall, does the client consistently take a lot of risk or little risk, or a mix?

- What is the max risk the client takes in any scenario, and which one?

- How much risk does the client take in low opportunity scenarios?

- Does the client take significant capital off the table in low opportunity scenarios compared to high opportunity scenarios?

- Does the client have any dollar thresholds they seem to anchor to?

- Does the client show irrational behavior?

In each of these cases, ask the client “why?” or “how were you thinking about that?”

In addition, compare the client’s answers to what they might have told you about their risk preferences. Sometimes, you’ll find clear differences between what a client says or thinks about themselves, and what the client actually does by way of their decisions.

These SAY/DO gaps are important discrepancies to explore more deeply with clients. They often turn into opportunities for you to deliver value to the client through:

- Education

- Helping the client discover something about themselves they wouldn’t otherwise have known

- Behavioral coaching

Leave A Comment

You must be logged in to post a comment.