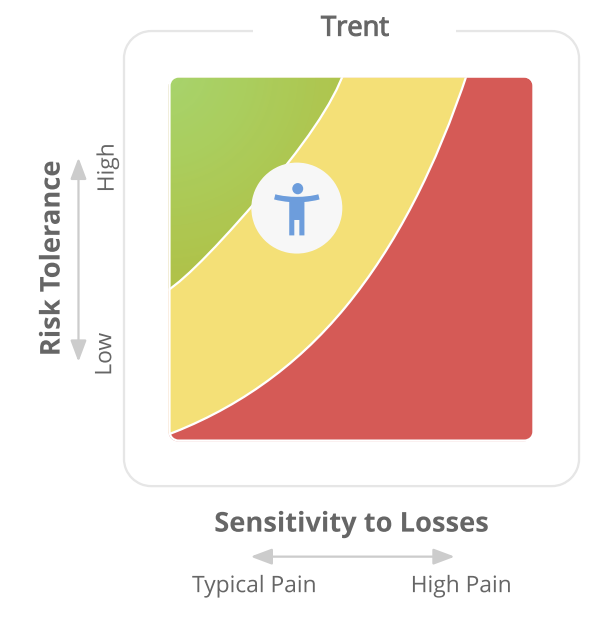

Upon completing the profiling activity, in addition to their risk scores, your clients will see their Investor Persona. Their persona reflects the combination of their risk tolerance and loss aversion, and places them into one of three zones: Growth-Minded (green), Calculated (yellow), or Cautious (red).

Clients who have higher risk tolerance/lower loss aversion are Growth-Minded. Those with low risk tolerance/higher loss aversion are Cautious. And those in between are Calculated.

We set the boundaries between so that the following percentages of the general investing population score into each zone.

- Growth-Minded: 25%

- Calculated: 50%

- Cautious: 25%

You can use these percentages to give your client a sense of where their risk preferences place them against the general investing population (i.e., for a Growth-Minded client, you can tell them “Your risk preferences place you in the Growth-Minded zone, along with 25% of the general investing population who show high tolerance for risk and low loss aversion.”)

For example, in the illustration above, the client (Trent) has moderate to high risk tolerance, but also a fair degree of loss aversion. That places Trent in the “Calculated” (yellow) zone. He shades a little closer to the Growth-Minded (green) zone, which places him around the 60-65th percentile of the investing public.

Leave A Comment

You must be logged in to post a comment.