Where risk tolerance describes a client’s posture toward risking losses for the chance at gains, loss aversion describes a client’s reaction when incurring losses. These are separate and distinct aspects of a client’s risk preferences—each has its own mathematical definition according to economics. And both are critical to understand when gauging a client’s risk preferences and determining how best to invest a client.

Why?

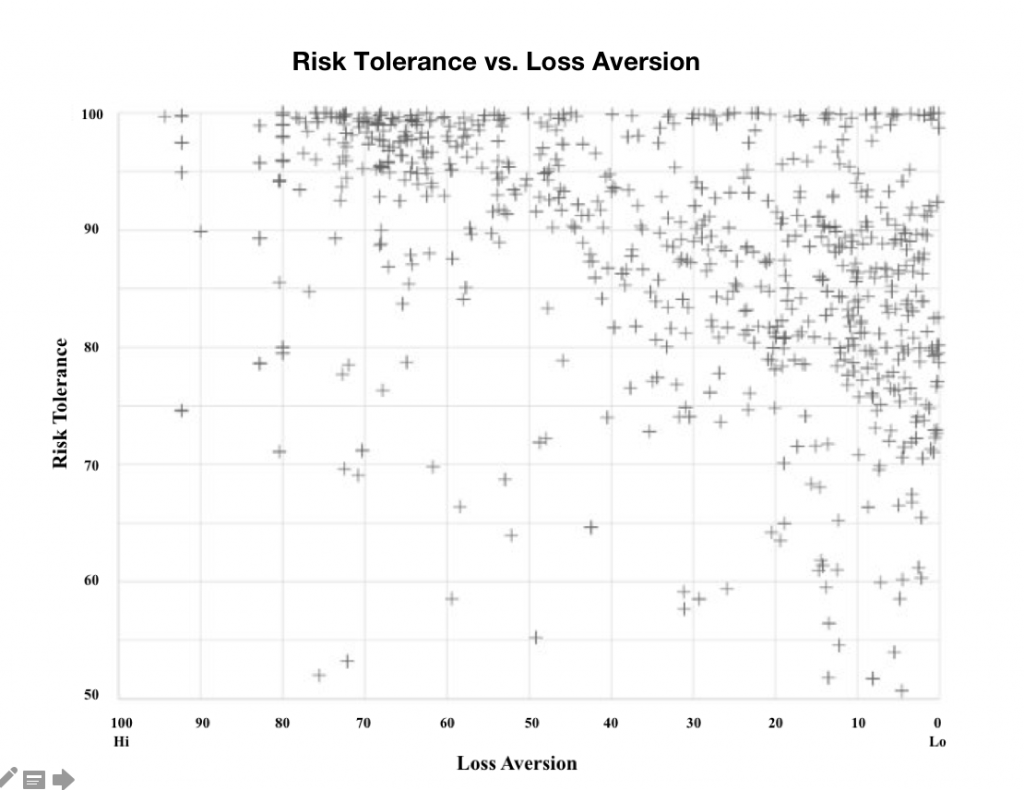

Studies show a very wide dispersion of risk tolerance and loss aversion across a population.

Clients will show all manner of mix between high/medium/low risk tolerance and high/medium/low loss aversion. It’s especially important to understand which of your clients have high risk tolerance AND high loss aversion. These clients often believe themselves to have high risk tolerance, and may push for a more aggressive portfolio. However, when markets dip, their loss aversion will kick in and lead them to make potentially rash decisions at exactly the wrong time.

Related FAQs:

Additional reference:

https://www.hartfordfunds.com/investor-insight/risk-aversion-vs-loss-aversion.html

Leave A Comment

You must be logged in to post a comment.